Buying a business is Risky. We mitigate that risk for you.

Find out why countless clients trust us to vet their acquisitions.

M&A Services

Quality of Earnings

QoE - Lite

Financial Model

Growth Strategy & Expansion

Inventory Management

Product Costing

Quality of Earnings

Ideal For

Buyers who have already executed a Letter of Intent (LOI) and require a comprehensive financial review of the target company, including a detailed reconstruction of the Profit & Loss statement. This assessment is ideal for sharing with private equity investors, banks, SBA lenders, and non-financial experts.

General Overview

Our Quality of Earnings (QoE) Report provides a thorough financial analysis, offering a precise and trustworthy evaluation of your target acquisition’s financial health. This comprehensive service includes a detailed review of financial data, contracts, and reporting practices, along with specialized due diligence, ensuring you make well-informed decisions with confidence.

Designed to equip prospective buyers with key insights, our report clarifies the business’s earnings quality, financial performance trends, and potential investment value, all supported by direct access to expert guidance.

What's Included in Quality of Earnings

- Read available background information (Target’s history, structure, and operations) and internal financial data and management reporting/analysis packages.

- Analyze the methodology for which the financial information for the Target is prepared, including any assumptions, adjustments, and allocations.

- Quality of revenue, expenses, key trends, earnings, management adjustments (add-backs)

- Review bank statements and perform Proof of Cash analysis.

- High-level analysis and commentary on trends in direct operating and SG&A costs incurred within the business Inquire about out of period, nonrecurring, unusual and non-cash items.

- Identify Customer and vendor concentration.

- Review management proposed adjustments to normalize EBITDA (If any)

- Review of balance sheet.

- Identify and assess off-balance sheet liabilities, accrued liability, and other environmental or litigation related liabilities Light tax review with the aim to identify any potential red flags only and not a full tax diligence..

- Analyze historical working capital trends, with a focus on seasonality, high/low points, potential normalizing items, and average run rate.

- Analyze a summary of accounts receivable, including aging and bad debt statistics.

- Analyze the composition of inventory and inquire about: Target’s inventory costing methodology, and write-down history, broken down by inventory-type.

- Analyze a summary of account payables, including aging statistics. Inquire about normal and special credit terms (including rebates), significant past due payables and disputes with suppliers.

- CAPEX Analysis: Analyzing capital expenditure trends and requirements..

- Analyze a summary of prepaid expenses, deferred cost of sales and other current assets to obtain an understanding of related impact on future earnings.

- Prepare and submit additional data requirements and questions relevant to our scope.

QoE Lite

Ideal For

Ideal if you need a comprehensive review of the target’s financials and analysis for internal use only and have already started some of the financial analysis.

General Overview

Our QoE Lite offers a ‘Lite’ examination of a business’s finances, compared to the comprehensive analysis conducted in our full-scope Quality of Earnings. The key distinction lies in the outputs provided; QoE Lite yields working Excel files that contain concise commentary and analysis, in contrast to the comprehensive PDF report furnished by our full-scope Quality of Earnings, which meticulously details and interprets all findings.

What's Included in QoE Lite

The services will include “Lite” financial due diligence for the past two fiscal years + YTD,

including but not limited to:

- Validate the financials.

- Analysis of revenue, operating expenses, key trends, earnings, management adjustments (add-backs) Review of key cost of the business (employees/contractors) and

- Review of balance sheet.

- Net working capital analysis (trailing 12 months)

- Light tax review with the aim to identify any potential red flags only and not a full tax diligence.

- Deliverable will be working Excel files with a short executive summary of our findings and limited commentary.

Financial Modeling Services

Ideal For

Online and traditional businesses that are looking to value the Business under different assumptions, validate seller asking price, and help create a business plan to execute after close.

General Overview

Our Business Valuation service may include, but is not limited to, advice and recommendations with respect to the review of financial projections, financial modeling, and inquiries with seller and client to identify range of projected valuation.

What's Included in Financial Model Services

- Excel book with Projection Model using the historical financials and projections for SBA plan.

- Assess the accuracy of financial projections and the reasonableness of assumptions underlying them.

- Includes business valuation and return on investment calculations; Break even analysis; Revenue forecast model; Expense break down, Amortization and depreciation schedule; Loan amortization schedule.

- Any financial arrangements for the acquisition will be fully integrated into your financial model to enable sufficient cash and debt covenant tracking.

- Easy to understand model that will be quick to update as the Business conditions changes.

Efficient Processes – Flawlessly Executed

1

Document Collection

The due diligence process starts with our streamlined document collection process. We work directly with the Seller(s) to get everything we need. You’ll be copied on all correspondences but we’ll take care of the heavy lifting.

2

Due Diligence

We collect data and work tirelessly to analyze your prospective acquisition, utilizing our decades of due diligence experience and proprietary software, all while keeping in communication with you.

3

Document Collection

We present everything we’ve found, and it won’t all be good. There’s a lot to take in so you’ll receive an easily consumable report for you to make an effective buying decision. We’re here to advise and help every step of the way, even long after we’ve delivered our findings.

Few key businesses that trust us in our M&A services

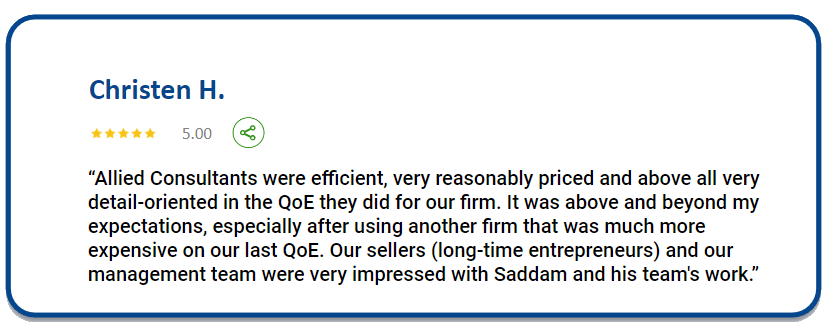

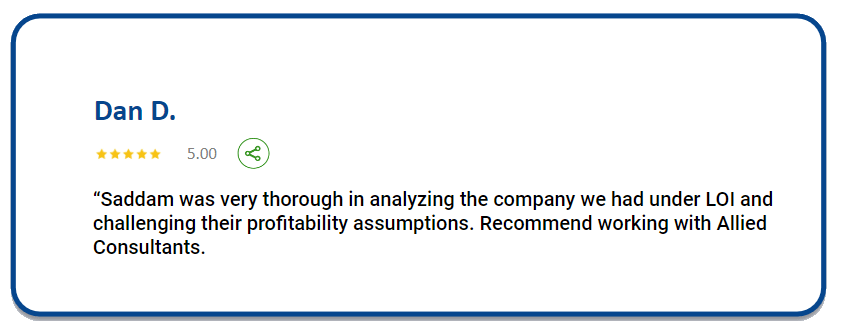

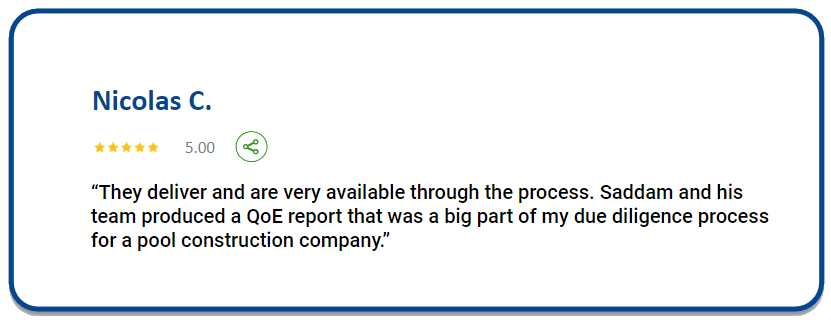

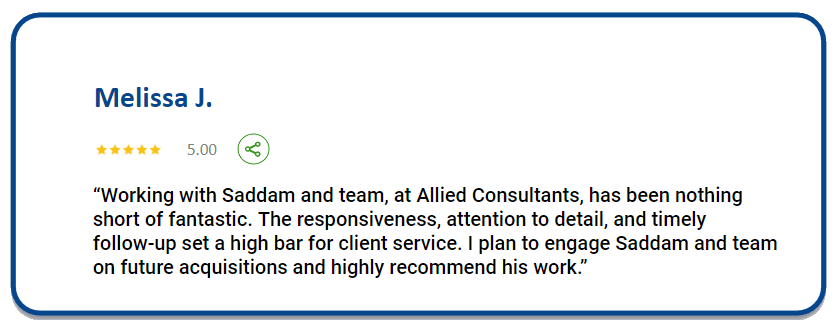

What you say about our services

Whether you’re a small business owner or a large corporation, we offer the best bookkeeping services to help you stay on top of your finances.