Bookkeeping & CFO services

Bookkeeping services

Services We Offer

Monthly Bookkeeping Support

Stay on top of your books with accurate, timely entries and reconciliations across platforms like Amazon, Shopify, Stripe, and PayPal.

Books Cleanup & Catch-Up

Fix messy or outdated books. We review, reconcile, and correct historical data so you start with accurate financials.

eCommerce Platform Integration

We connect your accounting software (QuickBooks or Xero) with your sales channels, payment processors, and inventory systems to ensure automatic, error-free syncing.

Cost of Goods Sold (COGS) Tracking

Accurate COGS allocation for each SKU, including landed cost calculations (shipping, customs, and packaging) to reflect true profitability.

Payroll & Contractor Payments

Hassle-free payroll management for your team and 1099 contractors with accurate deductions and tax compliance.

Sales Tax Tracking & Compliance

Stay compliant with state-wise U.S. sales tax filings. We help track liabilities and integrate with platforms like TaxJar or Avalara.

How Our Bookkeeping Solutions Work

Our Sell-Side QoE is designed to help founders get deal-ready, defend their valuation, and accelerate diligence by buyers and investors.

Personalized Onboarding

Streamlined Communication

Accurate Books

CFO services

Services We Offer

- Financial Strategy & Planning

-

Business financial roadmap

aligning financial strategy with growth goals. - Budgeting & forecasting setting realistic budgets and projecting revenue, expenses, and cash flow.

-

Scenario planning

modeling the impact of new channels (e.g., Amazon, Shopify, Walmart) or product launches.

- Cash Flow & Working Capital Management

- Cash flow forecasting – weekly/monthly cash visibility to avoid liquidity crunches.

- Inventory financing planning – ensuring funding for bulk purchases, seasonal spikes, or new SKUs.

- Payables/receivables optimization – negotiating supplier terms and improving collection cycles.

- Profitability Analysis

- Product-level profitability – analyzing margins after COGS, shipping, platform fees, ad spend, and returns.

- Customer acquisition cost (CAC) vs. lifetime value (LTV) – ensuring marketing spend drives sustainable growth.

- Channel profitability – comparing performance across Shopify, Amazon, wholesale, etc.

- KPI Tracking & Performance Dashboards

- Real-time dashboards – sales, gross margins, ad spend, inventory turnover.

- Unit economics – contribution margin per order/SKU.

- Operational KPIs – fulfillment costs, return rates, shipping efficiency.

- Strategic Advisory

- Scaling strategy – when to expand into new markets or channels.

- M&A support – due diligence for acquiring other brands or preparing for exit.

- Supply chain & pricing strategy – aligning operations with financial performance.

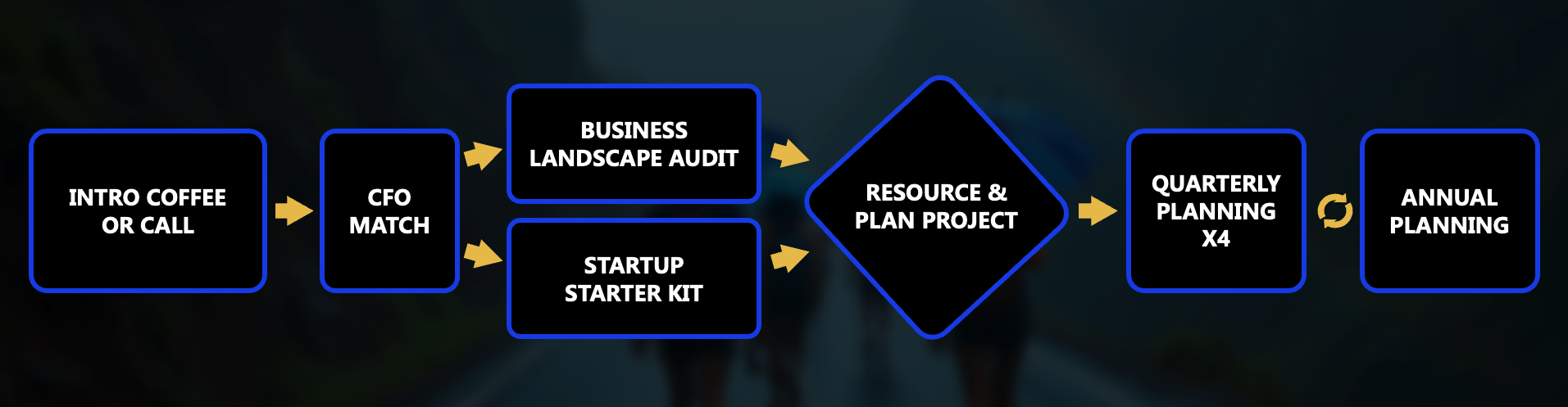

How do our CFO services work?

Why We're Different

-

Dedicated Team:

A consistent team familiar with your business ensures efficient and personalized service. -

24/7 Support:

Our support team is available around the clock to address your concerns promptly. -

Expert and Experienced Staff:

Our professionals bring a wealth of experience and knowledge to manage your finances effectively. -

Confidentiality:

We prioritize your privacy by using secure servers for sharing confidential information.

-

Software Discounts:

Benefit from our partnerships with leading software providers, offering you exclusive discounts. -

Tech-Forward Approach:

Our in-house team combines financial expertise with software engineering to implement and optimize accounting solutions. -

Scalable Services:

Our services adapt to your business growth, ensuring continued support at every stage.

Businesses We've Helped Succeed

We’ve partnered with founders, operators, and investors to provide finance, accounting, and strategic support at every stage of growth.

What Our Clients say about our services

We thought inventory planning needed expensive software. Allied Consultants proved us wrong. With just a spreadsheet model, they optimized our stock levels and reduced our frequent OOS issues

Their team did an excellent job with Inventory optimization & product mix planning. Our revenue & profitability increased

First off, thank you for the preliminary report – really polished and professional.

“Allied Consulta helped us transform our inventory chaos into a structured system. Their attention to detail, understanding of global supply chains, and proactive reporting gave us confidence to scale.”

“Saddam is knowledgeable and great person to work with.”

“I wanted to share my experience working with Allied Consultants. They did a good job managing our bookkeeping needs and were always prompt in responding to our requests. They were reliable and handled tasks efficiently, ensuring that our financial records were accurate and up to date. Whenever we had customs or needed assistance, they were quick to help out, which was appreciated. Great contributions to the team and definitely wishing them all the best.”

“Saddam has been a fantastic addition to our team. He is been incredibly cooperative, is an engaged team player, and strives to deliver to expense expectations. We will be hiring back Saddam right away (we’re just switching up our contract terms for our long term working relationship).”

Case Studies

Bookkeeping & CFO Services: Enhancing Financial Reporting for a Sewing Tools Brand

Bookkeeping & CFO Services: Restoring Financial Clarity for a Gym Equipment Brand

Operations Management & Customer Support Transformation: Madam Sew

Frequently Asked Questions (Bookkeeping)

What if I'm switching from another accounting software?

We facilitate a smooth transition by working from your closing balances to continue your bookkeeping seamlessly.

Do I need to provide all my previous financial records?

While not mandatory, having your previous records helps in ensuring continuity and accuracy. We primarily use your bank statements as our source of truth.

How do I share my financial documents securely?

We use secure platforms that allow you to connect your financial accounts directly, ensuring safe and efficient data transfer.

Will I have a dedicated bookkeeper?

Yes, you’ll be assigned a dedicated bookkeeper who understands your business and provides consistent support.

How often will I receive financial reports?

We provide monthly financial statements and are available to discuss them with you to ensure clarity and understanding.

Can you handle overdue bookkeeping?

Absolutely. Our catch-up bookkeeping services are designed to bring your financial records up to date efficiently.

Frequently Asked Questions (CFO)

Why does my eCommerce business need CFO

services if I already have a bookkeeper or accountant?

A bookkeeper records transactions and an accountant ensures compliance, but a CFO helps you understand the story behind your numbers. CFO services focus on strategy — improving profitability, managing cash flow, planning for growth, and making data-driven decisions.

At what stage should an eCommerce business hire CFO services?

If your sales are growing but you struggle with cash flow, inventory planning, or understanding profitability per SKU or channel, it’s time for CFO support. Typically, eCommerce brands doing $500K+ in annual revenue benefit most.

What type of financial insights will I gain from your CFO services?

You’ll have clarity on product-level margins, cash flow projections, ad spend efficiency, customer acquisition cost vs. lifetime value, and overall business health through real-time KPI dashboards.

Can you help me raise capital for my eCommerce business?

Yes. We prepare financial models, forecasts, and investor-ready reports to help you secure debt financing or attract equity investors.

How do CFO services improve cash flow management?

We provide weekly/monthly cash flow forecasting, optimize working capital, and help plan for inventory purchases, ensuring you have enough liquidity to scale without running into cash shortages.

Do you work with both Amazon and Shopify sellers?

Absolutely. We support multi-channel eCommerce businesses — whether you sell on Amazon, Shopify, Walmart, wholesale, or international marketplaces.

Can you support exit planning or M&A transactions?

Yes. We assist with financial due diligence, QoE analysis, and valuation support — helping you maximize your brand’s value when preparing for acquisition or exit.

How is your service different from hiring a full-time CFO?

Hiring a full-time CFO can cost $150K–$250K annually. Our fractional CFO services provide the same level of expertise and strategic insight at a fraction of the cost — flexible and scalable based on your business needs.

How do you deliver CFO services — virtually or on-site?

Our services are primarily virtual, which allows us to work seamlessly with eCommerce brands worldwide. We use cloud-based accounting, financial modeling, and reporting tools for real-time insights.

What is the first step to get started?

We begin with a financial review and discovery call to understand your current challenges. Then, we prepare a tailored CFO service plan aligned with your growth and profitability goals.